Would you not let the board work out what will change, how it affects dollars and cents of current enterprises and in the wings investment plans?

Or would you embark on a hostile take over, where you submit the deal and rather than wait for the deadline date to appear, fire as many shots off at the board to marginalise the board from the members, demonise the board to an extent to give the impression the board, going about its proper process of due diligence, is some how denying the members a right to decide?

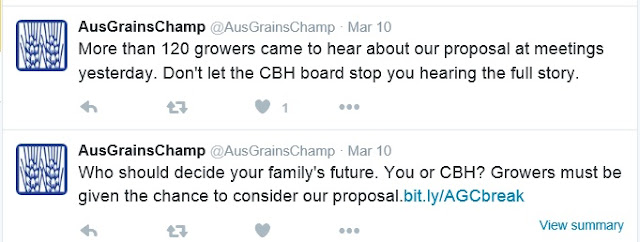

You decide...look at the screen shots of internet posts on FB & Twitter...all BEFORE the deadline hit

This one above (6 days til deadline) highlights 2 points. Lets split and assess.

- That growers do want to maintain control of CBH.

- If the board refuses the offer is that grower control?

The first one...if the company is public floated, it becomes a publicly listed company with shares bought and sold on the ASX.

- Some farmers will sell their shares, its a pointless exercise if no one ever sold their shares.

- These shares could and probably would be bought by non farmer/grower investors otherwise its a failed company and again a pointless exercise floating.

- A future board can also release new shares of any number at a nominal price to raise capital for new ventures, investment, mergers & acquisitions etc which would then further dilute the grow control unless all the shares sold went to growers, that is if all the millions required came from farmers ONLY. Fanciful.

- And of course there's the other likelihood that being a saleable company, foreign companies like ADM would come in and get up to 20% of the listing, so too could GrainCorp and so to could any speculators, super funds or institutions. Like Wesfarmers grower control can and will be lost.

Curious. Absurd, I have to say it was a silly statement and sad I was thought to be so silly as to swallow that.

When I asked how it got a little more fluid and then obvious it can't be assured and loss of control is assured if the company is any good. Wesfarmers again a classic example.

Second point, how on God's green earth is it that the board doing their job, fulfilling their role, rights and responsibilities a loss of grower control?

Second point, how on God's green earth is it that the board doing their job, fulfilling their role, rights and responsibilities a loss of grower control?

Can it be so? No. Its disingenuous, or it could be deliberately deceptive or its a silly rant from someone clueless. You choose, I'm still stunned.

AGC presented the proposal to the board, not the members. They could and still can, lob the entire proposal in the media, release it to everyone and let the members decide. They won't. I'd assume there will be some commercially sensitive facets they wouldn't want anyone improving on and lodging a superior or equal bid. Hence the "break fee" arrangement in the beginning.

Now the strategy appears to be one of marginalising the board from the members, demonising the board by wrongly suggesting the board is denying the members a right. Humbug.

Lodge the deal, then snipe at the board's reputation and integrity to gather and garner all the possible support from the growers that is possible...forget about the deadline, keep firing whilst the deadline is in place.

Lodge the deal, then snipe at the board's reputation and integrity to gather and garner all the possible support from the growers that is possible...forget about the deadline, keep firing whilst the deadline is in place.

It is worse than a hostile take over, its putting aside the facts about directors fiduciary duty and their legal requirements under law and suggest the members are being denied something.

Here's the thing, the board is elected to represent the members and has a lot of commercial sensitive information of its own it has to take into account when assessing the deal. You can't by pass the board and go straight to the members unless you want to talk about 30 pieces of silver up front and continue with "the devil's in the lack of detail approach".

The members elect the board to make these commercial decisions. AGC don't want you to have a group of people who are better placed to look at the deal than members. They want members with less information and less ability to assess the deal's impact on the entity, its operations, its strategic plan, its forward planning and its deals in process. They want members with less understanding or access to make a decision with less information than the board, the board is legally liable.

If the directors are failing in their fiduciary duty, its a breach of the Corporations Act and should be reported to ASIC immediately for a serious inquiry and possible prosecution under law. And yet AGC don't, the only thing they continue with is vacuous inferences that might cause some grower member's blood to boil. If you undermine the board, you undermine the members. That appears to be their aim...intentional or not. You decide

Here's the thing, the board is elected to represent the members and has a lot of commercial sensitive information of its own it has to take into account when assessing the deal. You can't by pass the board and go straight to the members unless you want to talk about 30 pieces of silver up front and continue with "the devil's in the lack of detail approach".

The members elect the board to make these commercial decisions. AGC don't want you to have a group of people who are better placed to look at the deal than members. They want members with less information and less ability to assess the deal's impact on the entity, its operations, its strategic plan, its forward planning and its deals in process. They want members with less understanding or access to make a decision with less information than the board, the board is legally liable.

If the directors are failing in their fiduciary duty, its a breach of the Corporations Act and should be reported to ASIC immediately for a serious inquiry and possible prosecution under law. And yet AGC don't, the only thing they continue with is vacuous inferences that might cause some grower member's blood to boil. If you undermine the board, you undermine the members. That appears to be their aim...intentional or not. You decide

In the meantime, this is what you're going to get...

AGC has now lifted the "Break Fee" and wants the board to accept the proposal, or give the decision to the members only.

"Don't let CBH board stop you hearing the full story" WHAT??? Where, when? If they have breached the Corporations Act why wouldn't AGC lodge a complaint with ASIC?

AGC, could send the entire deal to the members, but the members haven't the full access right across the whole CBH business. Why would you do that?

I have never seen a deal lodged like this, where the deadline hasn't been met and the director's integrity is being questioned by those submitting the deal. The board is being criticised for a denial of rights that does not exist.

Stunning adversarial attack. Let the board & management go about their business, putting out brush fires from grassy knoll snipers who lodge the proposal in the first place...sorry but that's a pretty low & disrespectful line of business behaviour. One theory circulating is that AGC are making it too hard to accept in the hope the board will reject and then present enough signatures for an extraordinary AGM to try & roll the board. It was something I put very little stock in, but I'm seriously left wondering now. When the 18th rolls around we'll see if the deal is accepted or not and what happens then. But hindsight will answer a few questions.

Due process and due diligence will be denied if the board is bypassed and that may be the intent.

AGC, could send the entire deal to the members, but the members haven't the full access right across the whole CBH business. Why would you do that?

I have never seen a deal lodged like this, where the deadline hasn't been met and the director's integrity is being questioned by those submitting the deal. The board is being criticised for a denial of rights that does not exist.

Stunning adversarial attack. Let the board & management go about their business, putting out brush fires from grassy knoll snipers who lodge the proposal in the first place...sorry but that's a pretty low & disrespectful line of business behaviour. One theory circulating is that AGC are making it too hard to accept in the hope the board will reject and then present enough signatures for an extraordinary AGM to try & roll the board. It was something I put very little stock in, but I'm seriously left wondering now. When the 18th rolls around we'll see if the deal is accepted or not and what happens then. But hindsight will answer a few questions.

Due process and due diligence will be denied if the board is bypassed and that may be the intent.

No comments:

Post a Comment